Consolidated Audit Trail

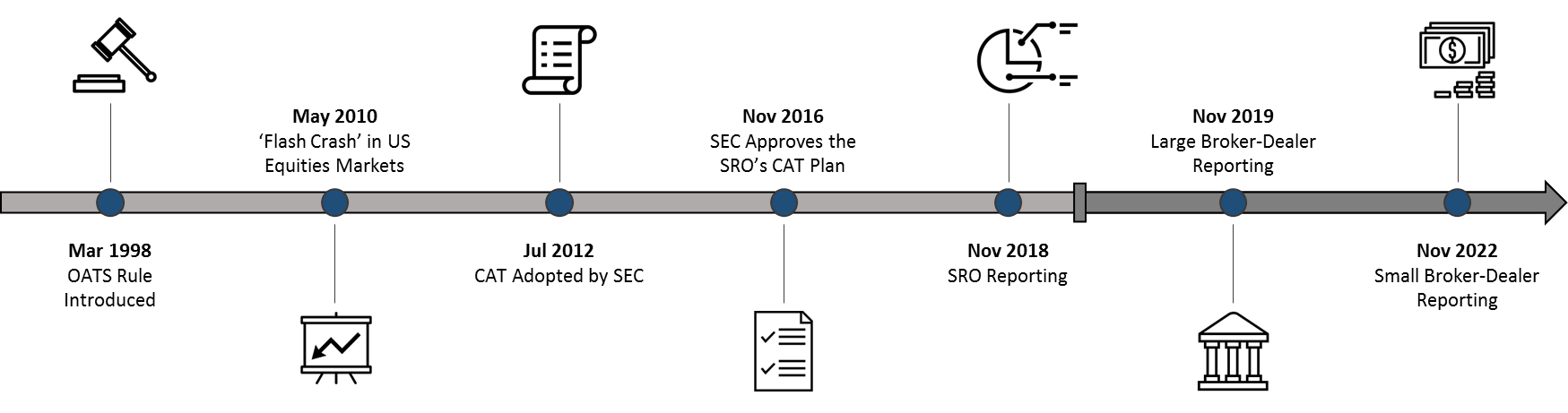

Whereas existing regulatory regimes like the order audit trail system OATS do not require customer-identifying information it must be included for CAT which has caused significant concern. In November 2016 the SEC S approved the CAT NMS Plan which was submitted by the.

Consolidated Audit Trail Broadridge

Consolidated Audit Trail Broadridge

What is the consolidated audit trail.

Consolidated audit trail. The Consolidated Audit Trail CAT is a massive government-mandated database that will track every equities and options market event in the US financial industry over a six-year period. The Consolidated Audit Trail is a reality Download the PDF Key requirements Broker-dealers conducting business in the US equity and options markets will be required to report order lifecycles for equities and options markets on a daily basis including orders quotes cancels routes including internal routes and allocations. 2012 to create Consolidated Audit Trail CAT the intended to allow regulators to monitor activity in National Market System NMS securities throughout the U markets.

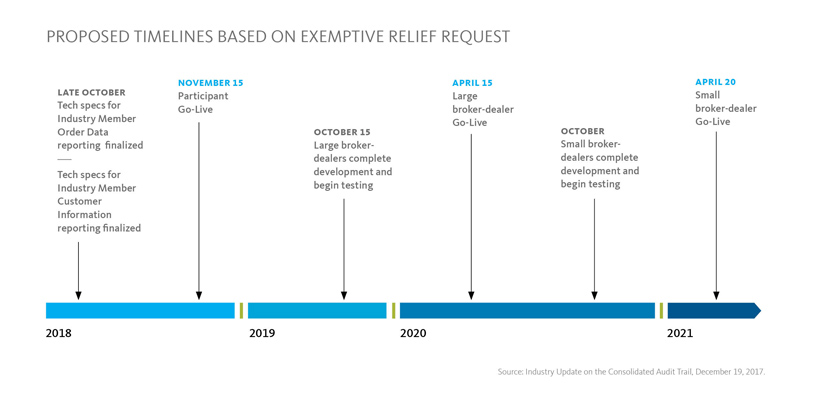

For listed-equities and options. In February the SROs announced changes to the timelines for industry member reporting to the CAT 1 and on February 26 the SROs announced a change in the vendor for plan. February 12 2019 Financial services.

What is the Consolidated Audit Trail. For orders received from or routed to an alternative trading system ATS the FINRA ATS MPID must be used. The Consolidated Audit Trail CAT is a central repository commissioned by the US Securities and Exchange Commission SEC intended to help regulators efficiently and accurately track activity in the US National.

As we look at the progress made with the Consolidated Audit Trail CAT in the last two years we see the impact of effective implementation practices including having talented dedicated personnel focused on setting and achieving well-articulated implementation details and milestones through engagement with internal and external stakeholders. An estimated 58 billion data points will be collected each. The Consolidated Audit Trail CAT is a regulatory reporting utility commissioned by the Securities and Exchange Commission SEC to enable regulators to more fully track trading activity and boost transparency.

The Consolidated Audit Trail. New CAT reporting requirements. SIFMA has published a Firms Guide to the Consolidated Audit Trail which is intended to educate industry members on the CAT enable a detailed understanding of the regulation and provide considerations for implementation including a readiness checklist.

Consolidated Audit Trail CAT SIFMA has long supported the efforts of the Securities and Exchange Commission SEC to create a comprehensive Consolidated Audit Trail that would enable regulators to efficiently and accurately track all activity throughout the US. April 13 2020 multiple releases June 22 2020 Phase 2a July 20 2020 Phase 2b. The consolidated audit trail is a paradigm shift in the regulation of US markets.

The Consolidated Audit Trail as outlined in the CAT NMS Plan is a collaborative endeavor between US exchanges FINRA and industry members to fulfill the SECs mandate to develop a more robust auditing system. Seq Linkage Discovery Step Feedback 1 Full Duplicate Checks When duplicates are found one record is kept and all others are rejected. Consolidated Audit Trail CAT Reconciliation Validation Reporting and Error Correction n-Tiers CAT offering couples our deep regulatory experience with our unique software platform to provide firms with a comprehensive solution for meeting their CAT reporting obligation while minimizing both cost and risk.

As equities and options reporting has been successfully implemented and reporting requirements are being expanded to include new message types as well as account information FIF continues to lead collaborative efforts with Industry Members the Plan Processor Plan Participants and Regulators to ensure. The task of reporting is obviously a mammoth one. Consolidated Audit Trail CAT - Overview.

Consolidated Audit Trail CAT SEC Rule 613 requires FINRA and the national securities exchanges to jointly submit a National Market System NMS plan detailing how they would develop implement and maintain a consolidated audit trail that collects and accurately identifies every order cancellation modification and trade execution for all. 2019 has started out to be very active for the Self-Regulatory Organizations SROs and the Consolidated Audit Trail CAT program. The CAT also heralds significant new obligations and reporting requirements for firms.

Though compliance deadlines are fast approaching theres still time for broker-dealers to take the lead in addressing data management challengesand ultimately disrupt through innovation. Updated August 20 2019. 9 If an Industry Member has more than one IMID the following criteria should be used to determine how to populate the senderIMID receiverIMID and destination fields.

2 Key Duplicate Checks When an Event key or a Firm ROE ID is duplicated all events.

Consolidated Audit Trail Cat Will Your Firm Be Ready To Report Oyster Consulting

Consolidated Audit Trail Text Medic

Firm S Guide To The Consolidated Audit Trail Firm S Guide To The Consolidated Audit Trail Sifma

Firm S Guide To The Consolidated Audit Trail Firm S Guide To The Consolidated Audit Trail Sifma

The Effects Of Consolidated Audit Trails On Broker Dealers

The Effects Of Consolidated Audit Trails On Broker Dealers

Consolidated Audit Trail Implementation Oyster Consulting

Consolidated Audit Trail Implementation Oyster Consulting

Sec Rule 613 Consolidated Audit Trail Compliance Deloitte Us

Sec Rule 613 Consolidated Audit Trail Compliance Deloitte Us

Kx Insights Consolidated Audit Trail Go Live Is Now A Certainty Kx

Kx Insights Consolidated Audit Trail Go Live Is Now A Certainty Kx

Consolidated Audit Trail Cat January 2020 Update Oyster Consulting

Monticello Consulting Group Consolidated Audit Trail A Reaction To The 2010 Flash Crash

Monticello Consulting Group Consolidated Audit Trail A Reaction To The 2010 Flash Crash

Consolidated Audit Trail Go Live Will Happen Patience Required Kx

Consolidated Audit Trail Go Live Will Happen Patience Required Kx

Https Www Catnmsplan Com Wp Content Uploads 2019 03 Cat Industry Call 03192019 Presentation Pdf

Consolidated Audit Trail Broadridge

Consolidated Audit Trail Broadridge

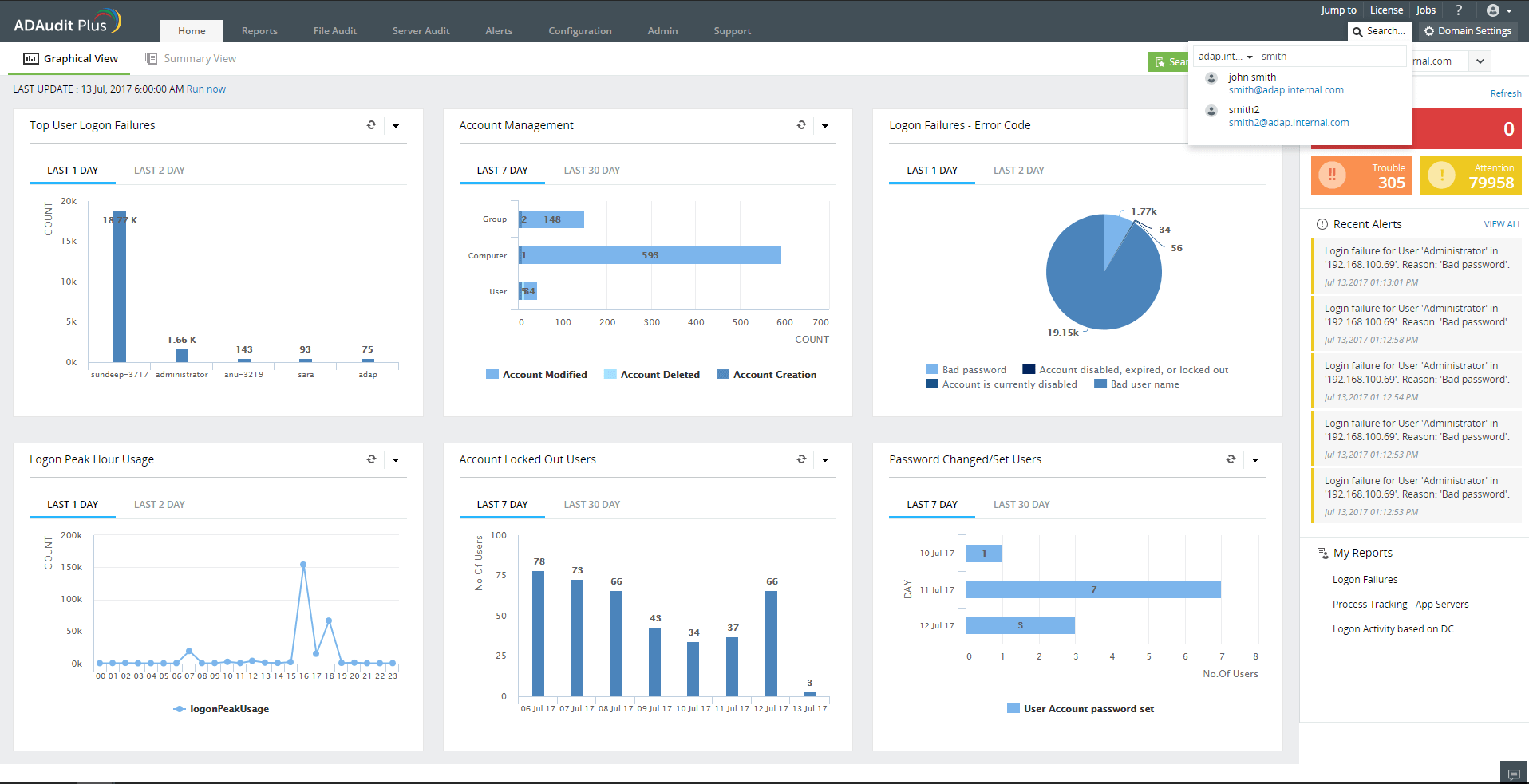

User Based Search For Consolidated Audit Trail Of Active Directory Changes

User Based Search For Consolidated Audit Trail Of Active Directory Changes

Consolidated Audit Trail Challenges Solutions Refinitiv Perspectives

Consolidated Audit Trail Challenges Solutions Refinitiv Perspectives

Comments

Post a Comment