How Esops Work

An employee stock ownership plan is something that a company offers to its employees that allows them to gain employee ownership in the company. An employee stock ownership plan ESOP is a qualified defined-contribution employee benefit plan that provides the employees of a business an ownership interest in that business.

What Is An Esop A Visual Guide To Employee Ownership

What Is An Esop A Visual Guide To Employee Ownership

An ESOP business model provide a companys workforce with an ownership interest in the company.

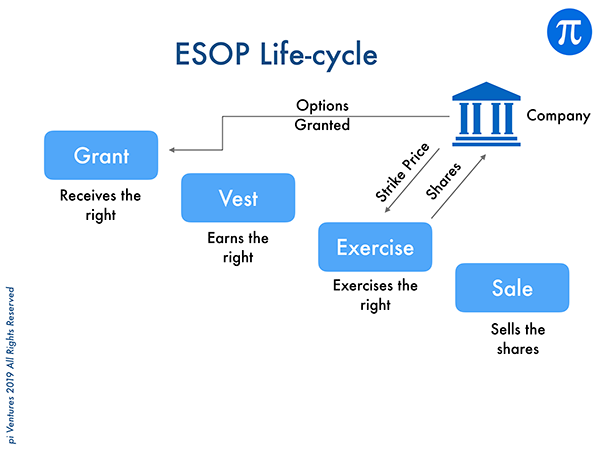

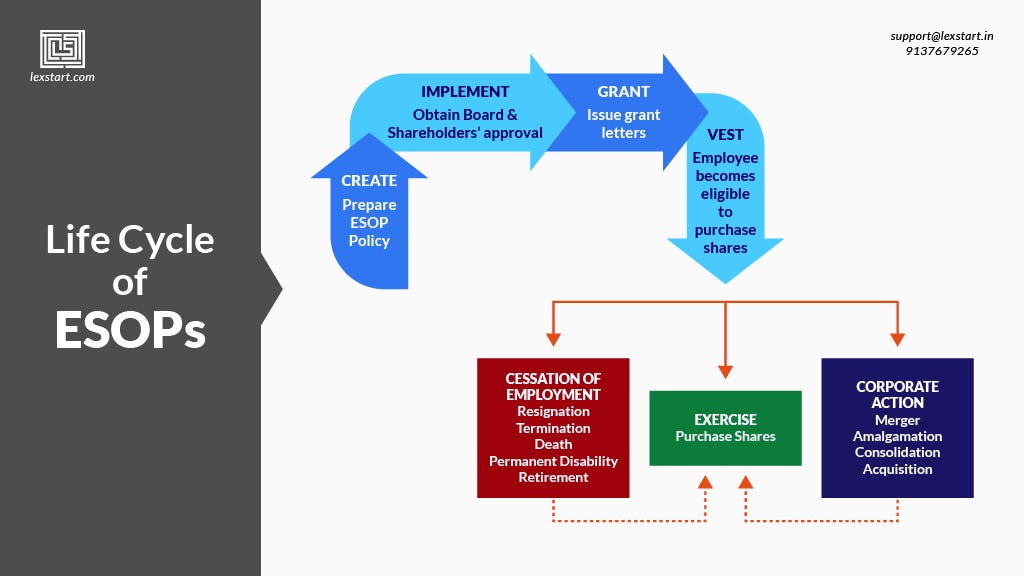

How esops work. An employee with ESOPs becomes a potential shareholder and can buy vested stock options ESOPs can be partially or completely monetized on liquidity events such as. How ESOPs Work How They Can Benefit You and Your Company. If owned by an ESOP the business can receive great tax benefits.

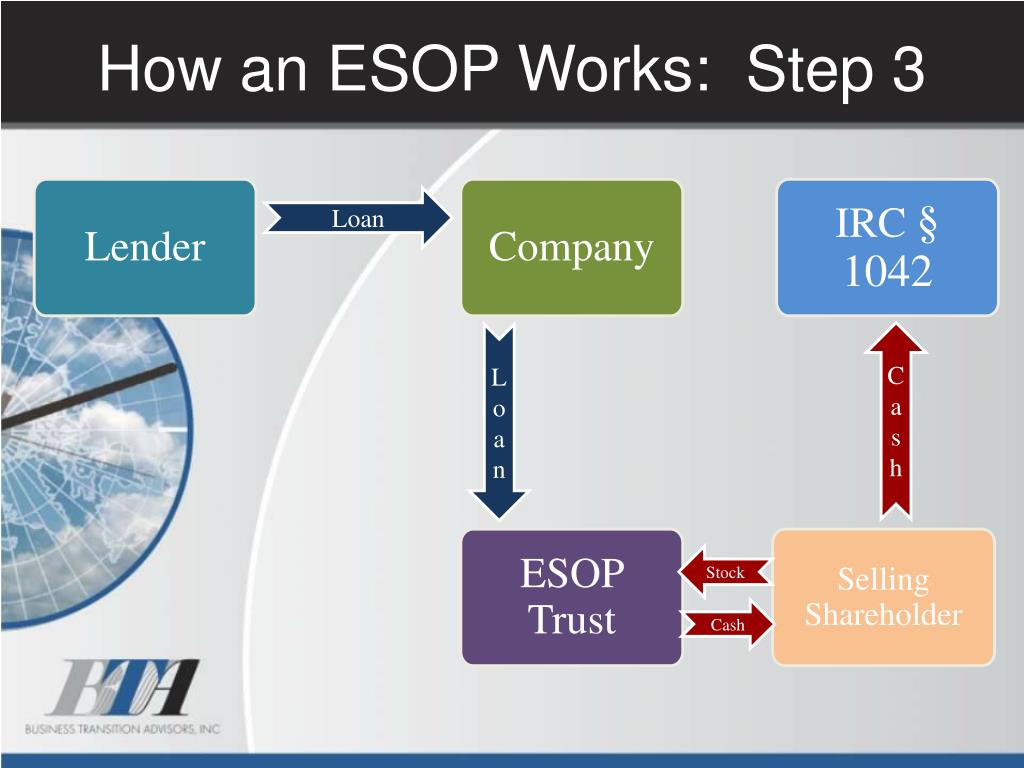

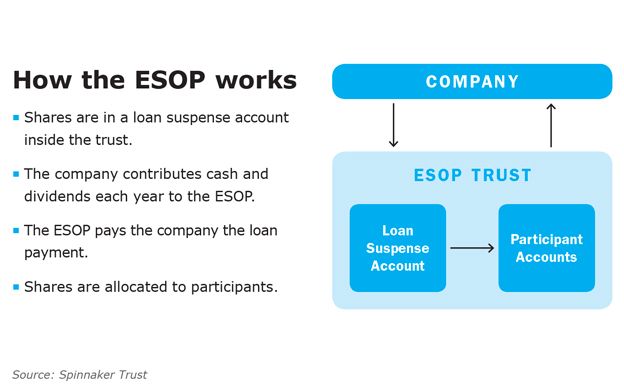

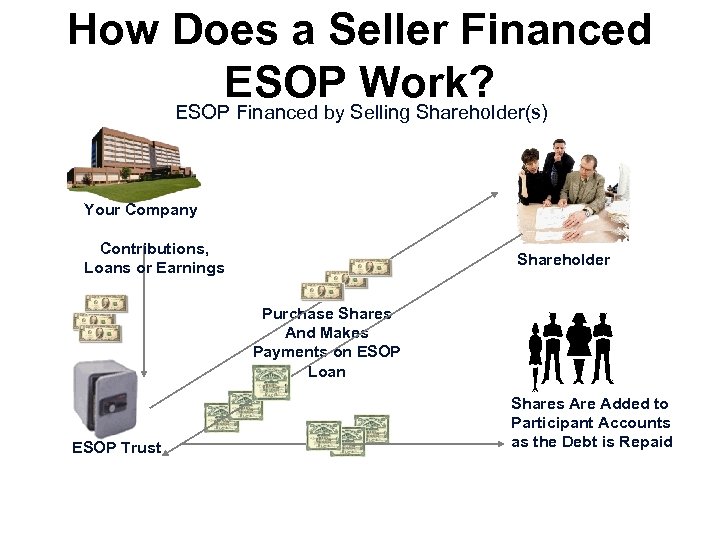

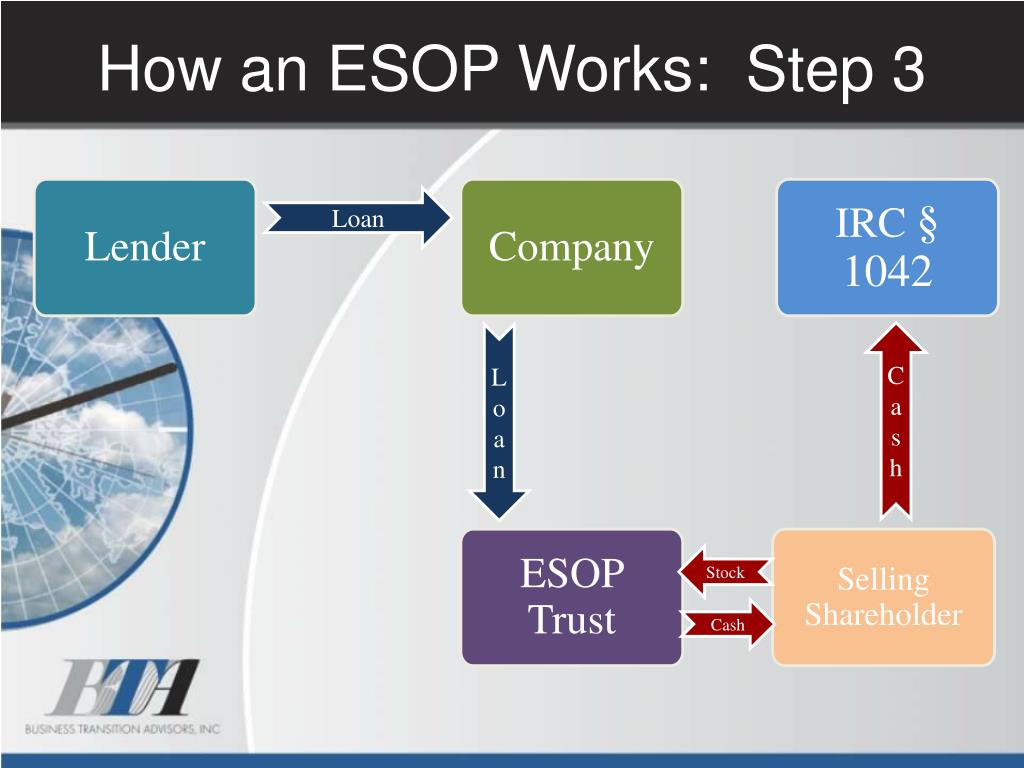

Carving an ESOP pool requires that all current shareholders dilute certain of their ownership to allocate to the ESOP Pool. IT Technology Operations November 4 2020 - 1100am - 1200pm. The Company funds its ESOP via annual contributions as a qualified retirement plan and the plan effectively uses those funds to repay the debt used for the purchase.

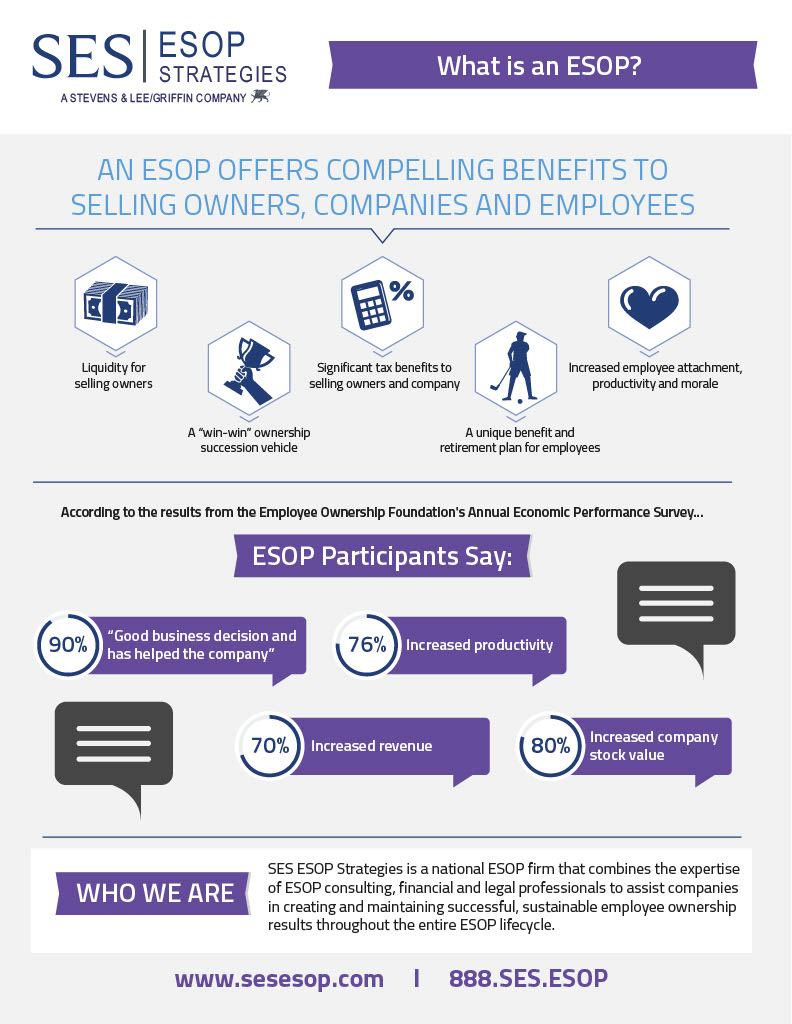

If the plan borrows money the company makes contributions to the plan to enable it to repay the loan. An ESOP is a way to empower employees of a company to become vested owners of their workplace. In this webinar we will discuss what an employee stock ownership plan ESOP is and how an ESOP can benefit business owners companies and employees.

The ESOP benefits employees since company contributions are provided on a yearly basis to the Employee Stock Ownership Plan both cash and stock. How ESOPs and the ESOP Pool work the basics. The presentation is a general overview with an.

ESOPs allow companies to provide their employees with stock ownership often at. An ESOP is used by employers to either reward employees or as an exit strategy from business ownership. At First Business Bank our teams work with many closely held companies that transfer ownership through ESOPs.

Companies set up a trust fund for employees and contribute either cash to buy company stock contribute shares directly to the plan or have the plan borrow money to buy shares. These benefits are allocated to the accounts of participating employees in the trust created as part of the Employee Stock Ownership Plan. ESOPs are tremendous retention tools because of the clear benefit they provide employees and because they align the interests of employees studies have shown that ESOPs generally boost the performance of a company.

Within these plans employees are given stocks in the company as a form of remuneration or they can be purchased which gives them employee ownership in the company depending on how much they own. Boost personal wealth through equity ownership Grow professionally as primary contributors Improve job security and satisfaction. ESOPs allow companies to borrow money and repay it pre-tax and they allow business owners to sell part or all of the company and defer tax on the profits.

Actively participate in decision making. As companies grow multi-fold they understand the value of loyal team members. ESOPs can provide smooth transitions of ownership particularly in cases where succession planning is a challenge.

The ESOP is set up as a trust that borrows money and uses it to buy company shares putting them in the account of every plan participant. What Is an ESOP and How Does It Work. Many people have misconceptions about ESOPs thinking for example that employees buy the stock or that an ESOP works like an equity compensation plan.

Most ESOPs are leveraged and involve bank financed purchases of either newly issued shares or more often the stock of a selling shareholder. How ESOPs Work See our infographic on how an ESOP works. Employee Stock Ownership Plans ESOPs are also known as Employee Share Ownership Plans.

To summarise ESOPs pave a way for employees to. An ESOP a tax-deferred combination stock option and retirement plan for employees. An ESOP is a type of employee benefit plan that acquires company stock and holds it in accounts for employees.

Founder S Guide For Building Esops For Their Venture By Pi Ventures Medium

Founder S Guide For Building Esops For Their Venture By Pi Ventures Medium

Esop 101 How An Employee Stock Ownership Plan Works Youtube

Esop 101 How An Employee Stock Ownership Plan Works Youtube

So You Ve Set Up Your Esop Now What Mainebiz Biz

So You Ve Set Up Your Esop Now What Mainebiz Biz

Employee Stock Ownership Plan Employee Meeting Template Presented

Employee Stock Ownership Plan Employee Meeting Template Presented

Employee Stock Option Plan For An Unlisted Company

Employee Stock Option Plan For An Unlisted Company

Esop Faq How Esops Work Ses Esop Strategies

Esop Faq How Esops Work Ses Esop Strategies

Ppt Employee Stock Ownership Plans Esops 101 Powerpoint Presentation Id 6567828

Ppt Employee Stock Ownership Plans Esops 101 Powerpoint Presentation Id 6567828

How An Esop Works A Visual Guide To Employee Ownership

How An Esop Works A Visual Guide To Employee Ownership

Lexgyaan Series On Esops Part 1 How Do Employee Stock Options Plan Esops Work By Lexstart Medium

Lexgyaan Series On Esops Part 1 How Do Employee Stock Options Plan Esops Work By Lexstart Medium

Esop Graphics Page 2 Line 17qq Com

Esop Graphics Page 2 Line 17qq Com

Employee Stock Ownership Plan How Esops Work Who They Re Right For

Employee Stock Ownership Plan How Esops Work Who They Re Right For

About Esops Information About What An Esop Is And How It Works Olson Mills Law Firm Llc

How Does An Esop Work Sdr Ventures Denver Investment Bank

How Does An Esop Work Sdr Ventures Denver Investment Bank

Comments

Post a Comment