Property Tax In Frisco Tx

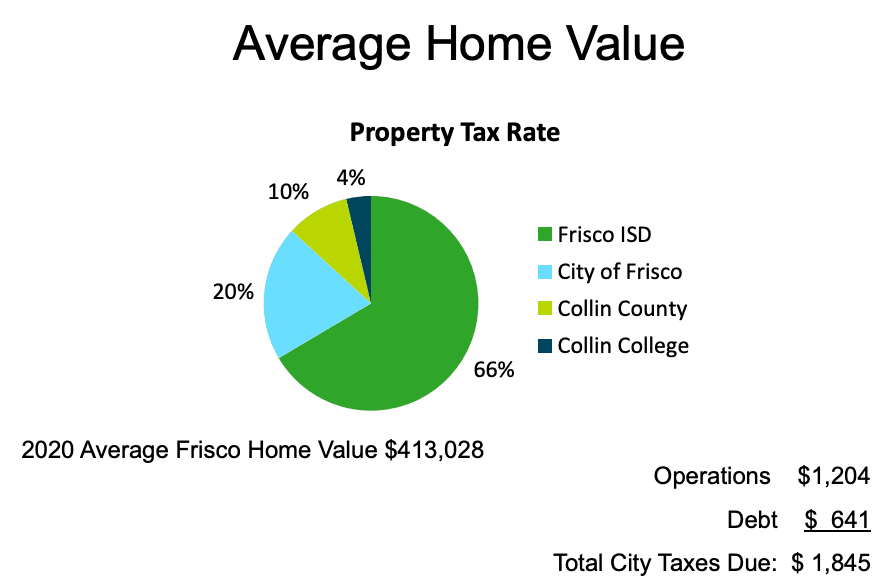

Total property tax City tax rate ISD tax rate County tax rate x assessed value of home 100. Frisco property titles and deeds.

Frisco Recommends Raising Property Taxes Texas Scorecard

Frisco Recommends Raising Property Taxes Texas Scorecard

Total property tax due can be calculated by the following formula.

/cdn.vox-cdn.com/uploads/chorus_image/image/65635647/FrsicoLead.0.jpg)

Property tax in frisco tx. 000 The total of all income taxes for an area including state county and local taxes. Property Taxes in Frisco TX. Name Denton County Tax Collector - Frisco Office Address 5533 Farm to Market Road 423 Frisco Texas 75034 Phone 940-349-3510.

Property Taxes 225. Property taxes become due on October 1. Tax Rates for Frisco TX.

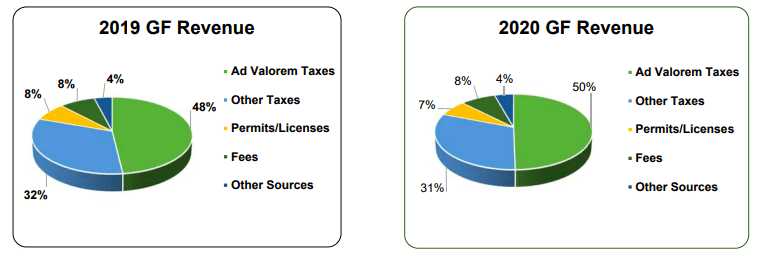

Amortized Over 13 Years. 1 from Denton County which will include Lewisville ISD and 1 from Collin County which will bill for the City of Frisco taxes due. 50 rows Furthermore some areas include special assessments for community colleges or for fresh.

Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal year. For current exemptions see Collin County Central Appraisal District website. Real Estate Taxes Amount.

Find Property Records including. Frisco Independent School District. City of Frisco Base Property Tax Rate.

Community Impact Newspaper Now is. Taxes can be paid in person on the second floor of City Hall George A. 254 rows For example the Plano Independent School District levies a 132 property tax rate and.

825 The total of all sales taxes for an area including state county and local taxes Income Taxes. Frisco is a planned community in North Texas that has been growing exponentially over the last several decades. You could be the next big thing in London Property Management.

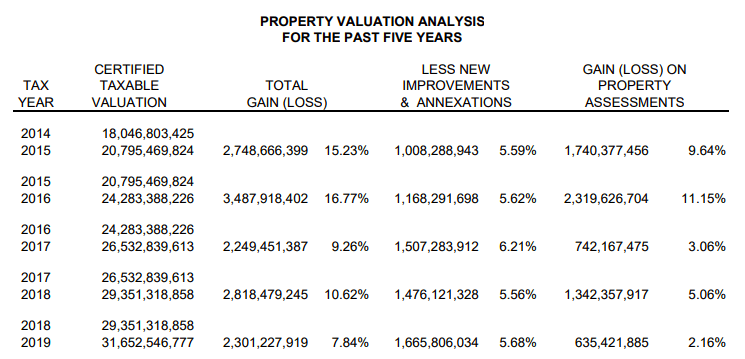

Those property owners living in Denton County will still receive 2 statements. Collin County Community College. Frisco TX Development Plateau How Property Taxes are Impacted.

How Property Tax is Calculated in Frisco Texas. That represents a 44 percent increase since 2013 when the average homeowners city property tax bill was 1278 and the average home valued at 276592. Taxpayers have until January 31 of the following year to pay their tax bill before taxes become delinquent.

Ad Looking for highly motivated Property Manager in London. Purefoy Municipal Center 6101 Frisco Square Boulevard. Several government offices in Frisco and Texas state maintain Property Records which are a valuable tool for understanding the history of a property finding property owner information and evaluating a property as a buyer or seller.

Address Phone Number and Hours for Denton County Tax Collector - Frisco Office a Treasurer Tax Collector Office at Farm to Market Road 423 Frisco TX. Denton County Tax Collector - Frisco Office Contact Information. Property Taxes 246.

Homes in Frisco Collin County Frisco ISD. Ad Looking for highly motivated Property Manager in London. Frisco Texas property taxes are typically calculated as a percentage of the value of the taxable property.

Motor Vehicle Taxes Amount. You could be the next big thing in London Property Management. The Collin County tax bill now includes Collin County City of Frisco Frisco ISD and Collin County Community College district taxes.

Federal income taxes are not included Property Tax Rate. Collin County Community College. The Collin County Tax Assessor-Collector Office is open 8am - 5pm Monday through Friday and 8am - 7pm on Wednesdays.

The City of Frisco offers a homestead exemption minimum 5000 which is evaluated annually. How do I calculate my Frisco Texas Property Tax. In recent years city planners and local government authorities have faced a serious concern that.

Rates vary widely across the country typically ranging from less than 1 at the low end to about 5 at the high end. At the citys proposed rate the average Frisco homeowner will pay 1845 in city property taxes on a home valued at 413028 up about 2 percent from last year. Sales Transfer Tax Percentage.

Homes in Frisco Collin County Prosper ISD. Based on 2013 tax rates the following rates may be subject to change. Assumes the local median home price and sales tax is amoritized over 13 years.

Homes in Frisco Denton County Frisco.

Frisco Recommends Raising Property Taxes Texas Scorecard

Frisco Recommends Raising Property Taxes Texas Scorecard

What Are Property Taxes Like In Frisco Texas

What Are Property Taxes Like In Frisco Texas

/cloudfront-us-east-1.images.arcpublishing.com/dmn/MNGSOUGZFZALJIAN3THOPO4DGQ.JPG)

Frisco Tx Property Tax Rates Acqusto Real Estate Tnt Videos

Frisco Tx Property Tax Rates Acqusto Real Estate Tnt Videos

City Of Frisco Raised Taxes 38 Percent Over Last Five Years Texas Scorecard

City Of Frisco Raised Taxes 38 Percent Over Last Five Years Texas Scorecard

What Are Property Taxes Like In Frisco Texas

What Are Property Taxes Like In Frisco Texas

Frisco Recommends Raising Property Taxes Texas Scorecard

Frisco Recommends Raising Property Taxes Texas Scorecard

Frisco Tx Development Plateau How Property Taxes Are Impacted

Frisco Tx Development Plateau How Property Taxes Are Impacted

Property Tax Rate Frisco Tx Official Website

Think Dallas Fort Worth Property Taxes Are High Well You Re Right

Frisco Officials Look For Compromise On Tax Caps Community Impact Newspaper

Frisco Officials Look For Compromise On Tax Caps Community Impact Newspaper

Frisco Recommends Raising Property Taxes Texas Scorecard

Frisco Recommends Raising Property Taxes Texas Scorecard

Comments

Post a Comment