Anti Money Laundering Certificate

The Certified Anti-Money Laundering Expert CAME is the benchmark in AML certifications. Deskripsi Pelatihan Anti Money Laundering.

Cerificate Templates Anti Money Laundering Certification Free

Cerificate Templates Anti Money Laundering Certification Free

This Anti-Money Laundering AML course has been designed to raise awareness for those individuals who work in the financial sector such as those looking after a company or organisations finances.

Anti money laundering certificate. Working in this sector requires complying with the Money Laundering Terrorist Financing and Transfer of Funds Regulations. The course is also suitable for. CAMS Certified Anti-Money Laundering Specialist is the global gold standard in AML certifications with more than 40000 CAMS graduates worldwide.

A practical introductory-level course that will give you a solid understanding of core money laundering and terrorist financing risks. Additionally governments and regulators consider it as a serious commitment to protecting the financial system against money laundering. Courses in each certificate cover a comprehensive list of anti-money laundering and fraud topics including.

Latest news reports from the medical literature videos from the experts and more. This industry-wide training program allows producers to complete core training just once and documentation is sent to every carrier they represent that participates in the program. The added benefits that Participants will receive include.

Insurance and financial professionals use AML training courses to familiarize themselves with the process of money laundering the criminal business used to disguise the true origin and ownership of illegal cash and the laws. AML Certification -This Course focuses on Anti-Money Laundering Laws Financial Crimes and Compliance. Take the course successfuly a Company AML training course certificate will appear on your screen.

Most insurers will accept this except Oxford Life and National Life Group. CAMS is currently available in. Online anti-money laundering training WebCE delivers up-to-date anti-money laundering AML training courses to a variety of insurance and financial professionals.

Suitable for operational or front-line staff as well as those considering embarking on a new career in AML as a stepping-stone for study at a higher level. This is a key program for those in banking financial compliance and enforcementBy attending this program. Newrecently appointed financial crime and risk officers.

This letter of comfort is intended to demonstrate that the various RBC business units are guided by enterprise-wide anti-money laundering and related policies in setting their own RBC policies and procedures. Ad AML coverage from every angle. Anti-Money Laundering Training Program is a fast easy and inexpensive way for financial services companies to meet key requirements of US.

We offer self-study and enhanced learning packages to get you qualified in as little as three months. The Certificate is suitable for those who work in the international private wealth management field and those who are looking to develop their understanding of anti-money laundering. Program governance and oversight customer onboarding monitoring detecting responding and regulatory reporting requirements.

TAKING AN AMLCFT RISK-BASED APPROACH AND MANAGING THE RISKS This module covers. The aim of the course is to present the importance of AML Compliance when conducting the regular business as well as the impact on entire society. What is an AMLCFT risk-based approach.

Many Outsourcing Giants IT companies financial institutions recognize the need of CAME professionals in their team. Save a copy of the certificate. Ad AML coverage from every angle.

Anti-Money Laundering Professional certificate program is designed to provide you with basics and advanced topics of Anti money laundering and counter financing of terrorism. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy. STEP Certificate in Anti-Money Laundering 6 STEP CERTIFICATE IN ANTI-MONEY LAUNDERING MODULE 4.

Latest news reports from the medical literature videos from the experts and more. FATF Guidance on the risk-based approach National risk assessments Determining the risks. This global certification of AML standards has been developed in response to requests for confirmation of AML standards across RBC.

Insurance Companies Must Establish Anti-Money Laundering Programs. The purpose of the Anti-Money Laundering AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing such as securities fraud and market manipulation. Ad Foreign Bank and Financial Accounts We E-File FBAR Form 114 Fast Easy.

This is proof of your Anti-Money Laundering Training. Newrecently appointed MLROs and deputies.

Anti Money Laundering Training Online Course Ihasco

Beoptimized Sas Aml And Fraud Detection

Beoptimized Sas Aml And Fraud Detection

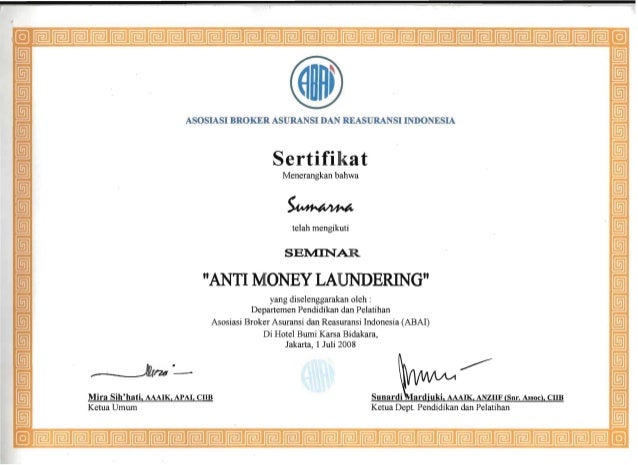

1 Juli 2008 Anti Money Laundering

1 Juli 2008 Anti Money Laundering

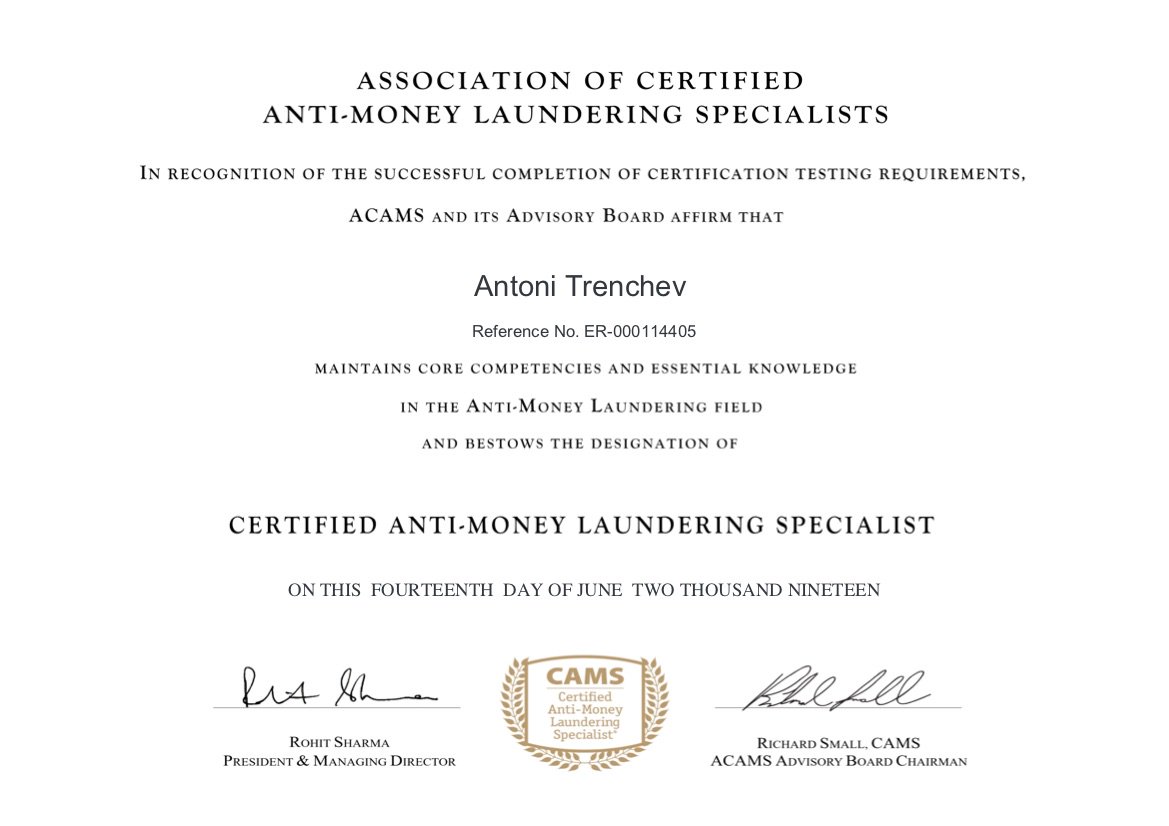

Antoni Trenchev On Twitter Quite Proud To Be A Certified Anti Money Laundering Specialist From Acams Aml Compliance And Rigorous Aml Mechanisms Are The Backbone Of Every Robust Financial Institution Such As Nexofinance And

Antoni Trenchev On Twitter Quite Proud To Be A Certified Anti Money Laundering Specialist From Acams Aml Compliance And Rigorous Aml Mechanisms Are The Backbone Of Every Robust Financial Institution Such As Nexofinance And

Anti Money Laundering And Counter Financing Of Terrorism

Anti Money Laundering And Counter Financing Of Terrorism

Anti Money Laundering Certificate

Anti Money Laundering Certificate

Certified Anti Money Laundering Professional Swiss School Of Business And Management Geneva

Certified Anti Money Laundering Professional Swiss School Of Business And Management Geneva

Https Www Anti Moneylaundering Org Document Default Aspx Documentuid F0eb992e 3a77 4395 A57b 1e64e85bb4e4

The Black Money Decoy 2016 Kairus Org Linda Kronman Andreas Zingerle

The Black Money Decoy 2016 Kairus Org Linda Kronman Andreas Zingerle

Anti Money Laundering Certificate

Anti Money Laundering Certificate

Compliance Anti Money Laundering Terrorist Financing Sanction Icc Indonesia

Compliance Anti Money Laundering Terrorist Financing Sanction Icc Indonesia

How Can The Acams Anti Money Laundering Foundations Certificate Benefit Your Organization Fahad Hizam Alharbi

How You Can Ica Fake Certificate In 24 Hours Or Less For Free Fake Diploma Market

How You Can Ica Fake Certificate In 24 Hours Or Less For Free Fake Diploma Market

Comments

Post a Comment